Benefits of Filing Form 1099 Online

With our exclusive and time-saving features, you can easily File Form 1099 online.

Easy & Secure Filing

E-file Your 1099 Forms easily and securely with our e-filing software and deliver the recipient copies by mail or online

Supports State Filing

In addition to Federal e-filing, we also support State filing with the required State agencies.

Built-in Error Check

Our internal audit feature reviews your return before transmitting it to the IRS to ensure accuracy and lower the chances of rejection.

Print & Postal Mail

The Postal Mailing option enables clients to seamlessly send their recipients copies of their tax forms.

Online Access

Go paperless. Grant your recipients access to view and download their 1099 Forms via a secure online portal.

Supports 1099 Corrections

We make the process of filing 1099 corrections for any rejected returns easy and accurate.

Fill out & share your W-9 online

TaxBandits’ Fillable W-9 solution allows users to complete and e-sign the W-9 form in minutes quickly, Our system performs basic data validations to ensure accuracy and error-free completion. W-9s are securely stored, allowing users to access, edit, or share them anytime.

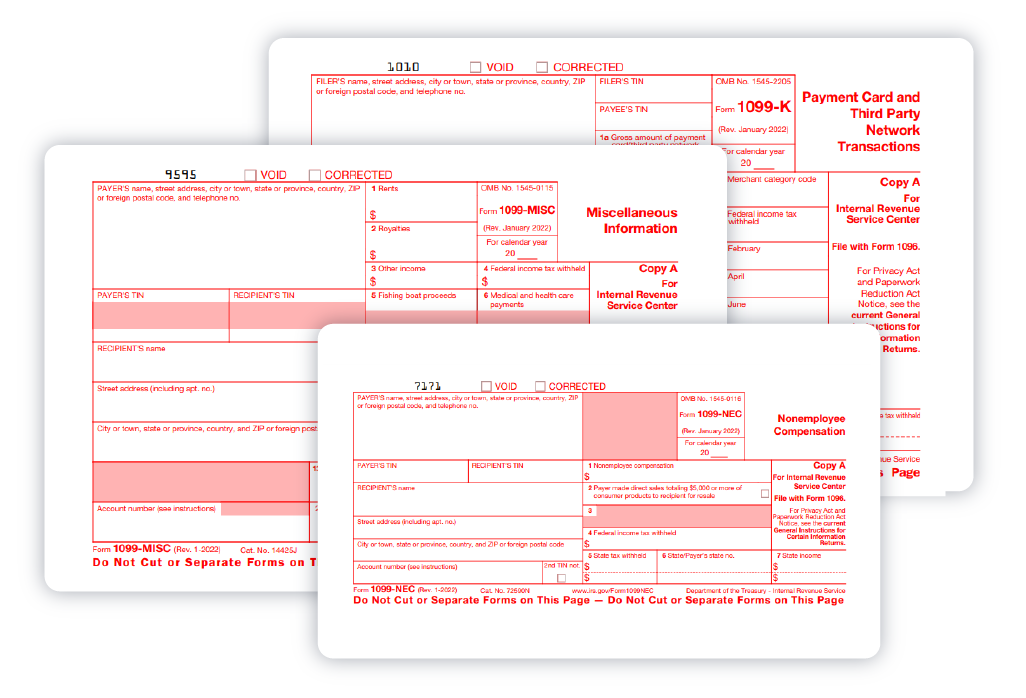

Supported 1099 Forms

Form 1099-NEC

The Form 1099-NEC is used to report payments made to non-employees. In general, if payments of $600 or more to a vendor, independent contractor, or freelancer during the tax year, the payer must file Form 1099-NEC.

Form 1099-MISC

The IRS Form 1099-MISC is used to record miscellaneous information. Miscellaneous revenue includes payments for rent, royalties, and services performed by independent contractors.

Form 1099-K

Form 1099-K reports online payments and transactions made during the tax year using third-party networks ( payment apps and online marketplaces) and Payment cards (credit, debit cards, and stored value cards).

Form 1099-INT

Form 1099-INT is used to report interest revenue of $10 or more paid to any recipient during the tax year.

Form 1099-DIV

A Form 1099-DIV is a yearly tax statement provided to investors from an investment fund. Form 1099-DIV includes income from dividends of more than $10, including exempt-interest dividends and capital gains dividends.

Form 1099-R

Form 1099-R is used to report distributions from retirement or profit-sharing programs, insurance, pensions, annuities, and other financial instruments.

We are a one-stop solution to e-file 1099 Form returns, such as Form 1099-S, 1099-B, 1099-C, 1099-G, 1099-PATR, 1099-SA, 1099-OID, 1099-Q, and more. With our software, you can quickly and securely e-file your returns with the IRS, as well as deliver copies of the forms to your recipients through postal mail or online.

When is the deadline to File 1099 Forms?

The deadlines for the most of 1099 Forms are the same. Here are the 1099 form filing deadlines.

Form 1099 Recipient Copies should be furnished to the recipient on or before

January 31st.

Form 1099 Paper Copies must be filed with the IRS by

February 28th.

Forms 1099 should be e-filed with the IRS on or before March 31st.

Note:If the deadline falls on a weekend or federal holiday, the next business day automatically becomes the deadline.

There are certain exceptions to these deadlines.

-

Form 1099-NEC must be filed before January 31. You must also provide a recipient copy on or before

the deadline. -

If you report payments in boxes 8 or 10 of Form 1099-MISC, the deadline for reporting recipient copies is

February 15. - The recipient copies of Forms 1099-S and 1099-B must be filed by

February 15th.

How to File Form 1099 Online

We provide an e-filing method that is simple, secure, and designed for accuracy.

Simply follow these simple steps to begin filing Form 1099. Once you have reviewed and transmitted your Form, We will keep you updated on its status with the IRS.

Choose your 1099 Form

Enter the Form 1099 details

Review Form 1099 Information

Transmit your Form to the IRS/State

Deliver Recipient copy through online or postal mail

Integration Partners

Connect your accounting software to import data and e-file 1099 Forms seamlessly.

Frequently Asked Questions

Payers who make certain types of income or transnational payments to recipients during the tax year must file a 1099 form depending on the amount of the payment. Payers can be an individual, business, or government entity.

Form 1099 is often provided to individuals or companies who receive specific types of income/payments during the tax year. This includes:

- Payments made to Non-Employees

- Miscellaneous Information

- Payments made through Payment Card and Third Party Network Transactions

- Dividends received from stocks

- Interest from banks

| Form 1099-K | Form 1099-NEC | Form 1099-MISC | |

|---|---|---|---|

| Payment Types | Any payments received through Third-party Networks or Payment cards | Non-employee compensation | Miscellaneous payments such as Rent, Attorney, Royalties, and other payments |

| Payment Mode | Payment Apps, Credit cards, Debit Cards, Stored Value Cards | Cash, Check, ACH, Direct Deposit | Cash, Check, ACH, Direct Deposit |

| Threshold | $600 or more regardless of transaction | $600 or more | $600 or more (Exemption Apply) |

| Who must File | Payment Processor (Payment Card Companies, Payment Apps, and Online Marketplaces) | Payer (Business or Individuals) | Payer (Business or Individuals) |

| Deadline to File | Recipient Copy - Jan 31st, 2024 Paper Filing - Feb 28th, 2024 E-Filing - Apr 1st, 2024 | Recipient Copy - Jan 31st, 2024 Paper Filing & E-Filing - Jan 31st, 2024 | Recipient Copy - Jan 31st, 2024 Paper Filing - Feb 28th, 2024 E-Filing - Apr 1st, 2024 |

Failure to file Form 1099 before the deadline or providing incorrect information may result in IRS penalties. Penalties range from $60 to $630, depending on when Form 1099 is filed with the IRS.

| Delay | Penalty Amount |

|---|---|

| 30 days after due date | $60/form |

| Beyond 30 days but before Aug 1st | $120form |

| After August 1st | $310/form |

| Intentional Disregard of filing | $630/form |

Ready to File 1099 Forms?

Filing your Form 1099 should be easy and secure. Complete your form and get instant IRS status updates.

.png)

.png)